unemployment tax break refund update september 2021

The tax break is for those who earned less than 150000 in. Unemployment tax break refund update september 2021.

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

The American Rescue Plan which President Joe Biden signed in mid-March waived federal tax on up to 10200 of unemployment benefits per person.

. At this stage unemployment. 117-2 on March 11 2021 with respect to the 2020 tax year. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option.

The IRS is sending unemployment tax refunds starting this week. The state Department of Revenue provided an update to 11Alive. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. Will I receive a 10200 refund. Individual tax filing due date.

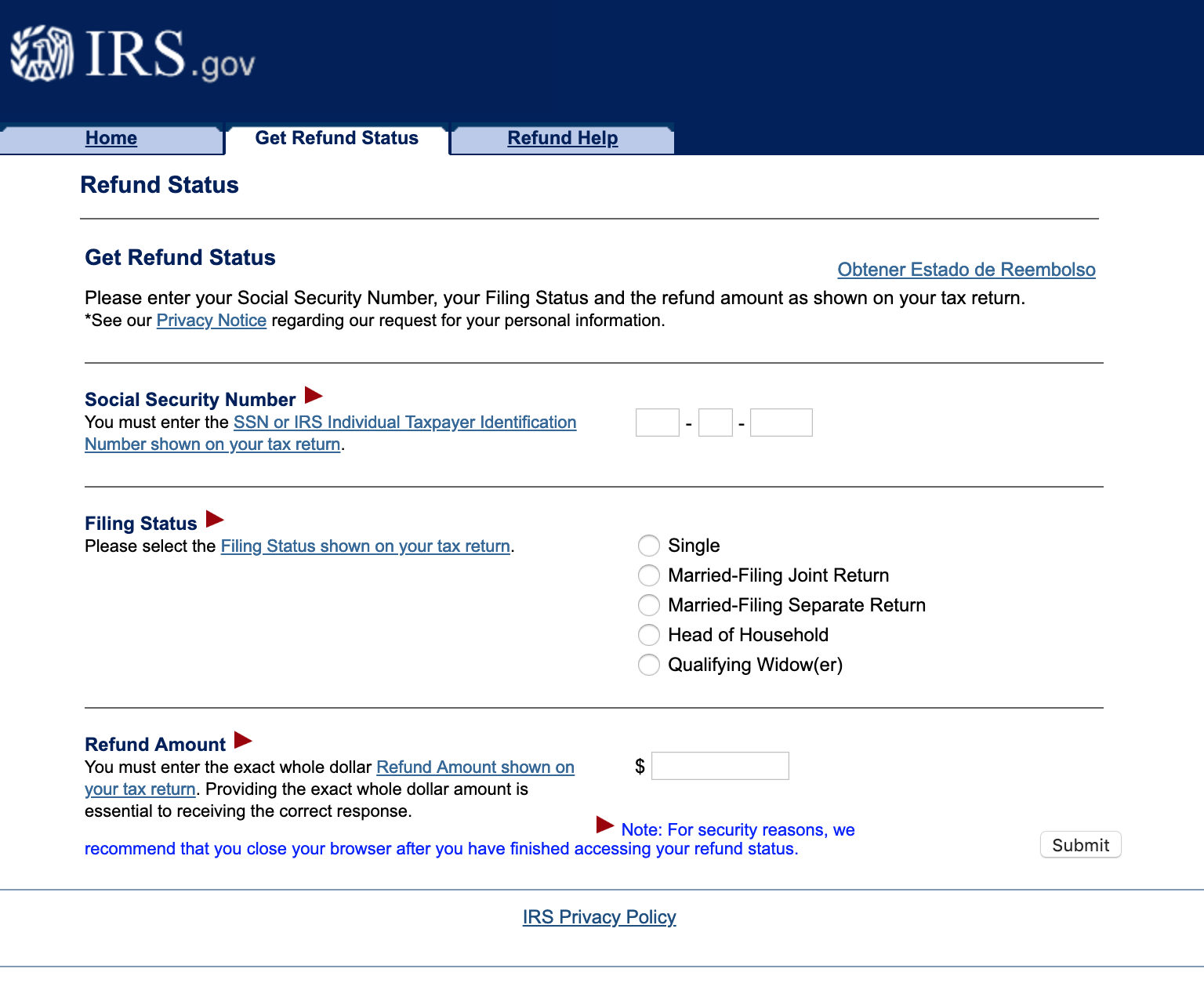

May 17 2021 was April 15 2021 Unemployment income. Another way is to check your tax transcript if you have an online account with the IRS. The American Rescue Plan that was enacted on.

Tax Day Deadline In 3 Weeks What Happens If You File A Tax Extension Tax Extension Tax Refund Filing Taxes September 13 2021. The average refund for those who overpaid taxes on unemployment compensation. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income.

Reminders and tips Accounting firm. By Anuradha Garg. The Internal Revenue Service has sent 430000 refunds.

With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million. September 13 2021. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020.

The IRS will start. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. This is the fourth round of refunds related to the unemployment compensation exclusion provision. Unemployment Stimulus Am I Eligible For The New.

These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Adjusted gross income and for unemployment insurance received during 2020. The IRS began making adjustments to taxpayers tax returns in May in the first of several phases to correct already filed tax returns to comply with the changes under the.

During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. Good news -- if you filed your 2020 taxes without claiming a tax break on your unemployment income the IRS will take care of it for you. By that date some.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. IRS tax refunds to start in May for. The unemployment exclusion was enacted as part of the American Rescue Plan Act PL.

10200 per person not subject to federal tax was taxable A surprise tax break for 2020 was passed. The American Rescue Plan waived federal tax on up to 10200 of unemployment benefits per person. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

To answer your question Yes currently all unemployment income will be taxable when you file your 2021 federal tax return. Updated March 23 2022 A1. Unemployment benefits tax break.

117-2 on March 11 2021 with respect to the 2020 tax year. The newest COVID-19 relief bill the American Rescue Plan Act of 2021 waives federal taxes on up to 10200 of unemployment benefits an. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in. 22 2022 Published 742 am.

Irs Refund Status Unemployment Refund Schedule Is Delayed Marca

4th Stimulus Check 1400 For Senior Payment Updates September Child Tax Credit Delayed

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

More Of Those Surprise Tax Refunds Go Out This Week The Irs Says Will You Get

Surprise Refunds To Be Given To Thousands Of Americans By End Of December Will You Get One

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

Irs Refund Status Unemployment Refund Schedule Is Delayed Marca

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Irs Refund Status Unemployment Refunds Coming Soon Marca

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year

Heartbreaking Stories Emerge As Millions Await Tax Refunds Or Stimulus Payments From Irs Fingerlakes1 Com

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times